The Challenge

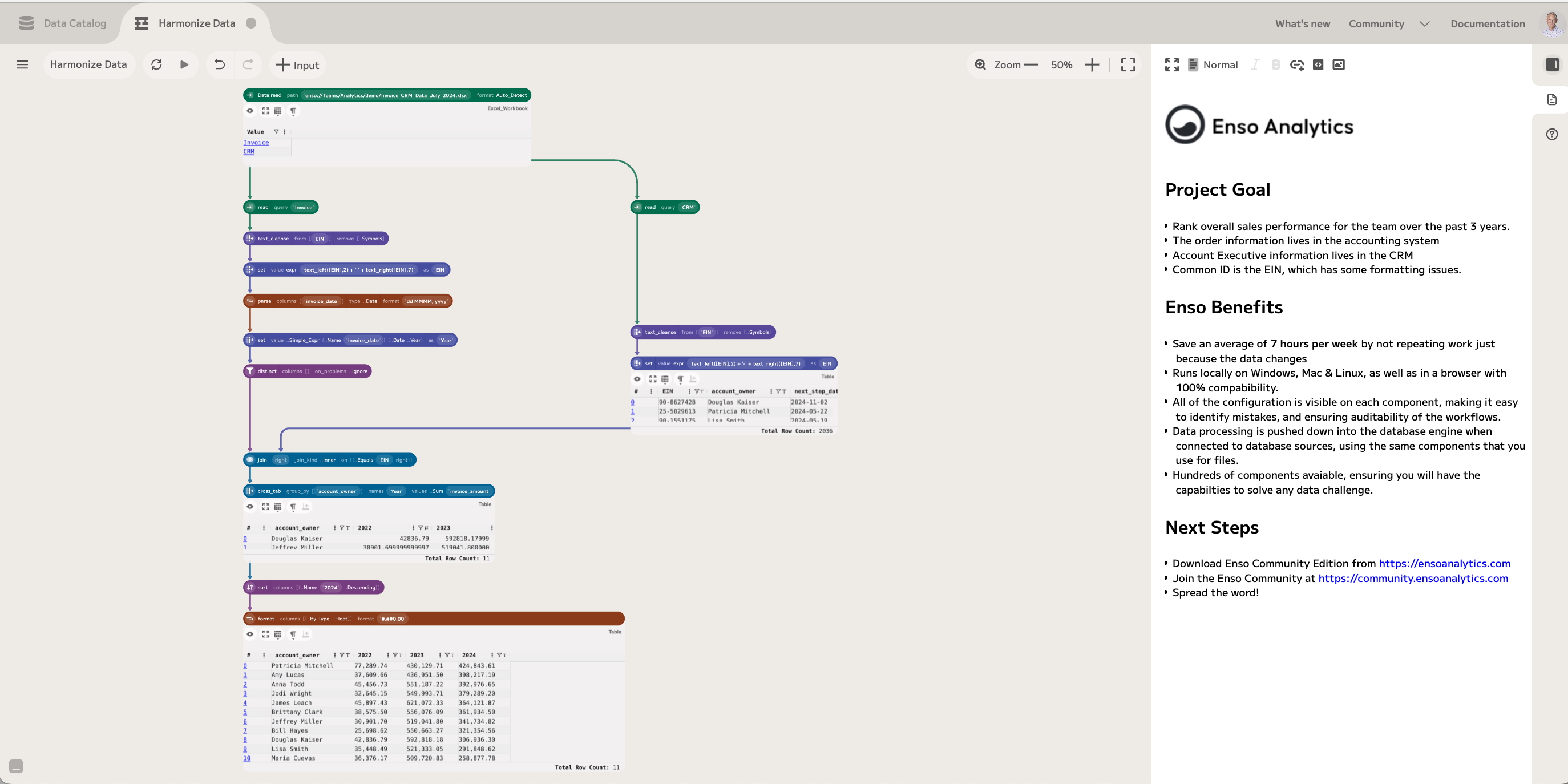

A mid-sized financial services firm faced significant operational challenges with data fragmented across four systems: two proprietary platforms, NetSuite, and Salesforce. The finance team spent weeks manually consolidating information for basic reporting, making profitability analyses nearly impossible to complete efficiently and compromising data accuracy.

“We were drowning in spreadsheets. AR (Accounts Receivable) aging alone consumed a full week each month, and every step required human interaction.”

— CFO, Mid-sized Financial Services Firm

Finding the Right Solution

The team initially evaluated several options, including Alteryx. However, they ultimately chose Enso Analytics for its distinctive advantages.

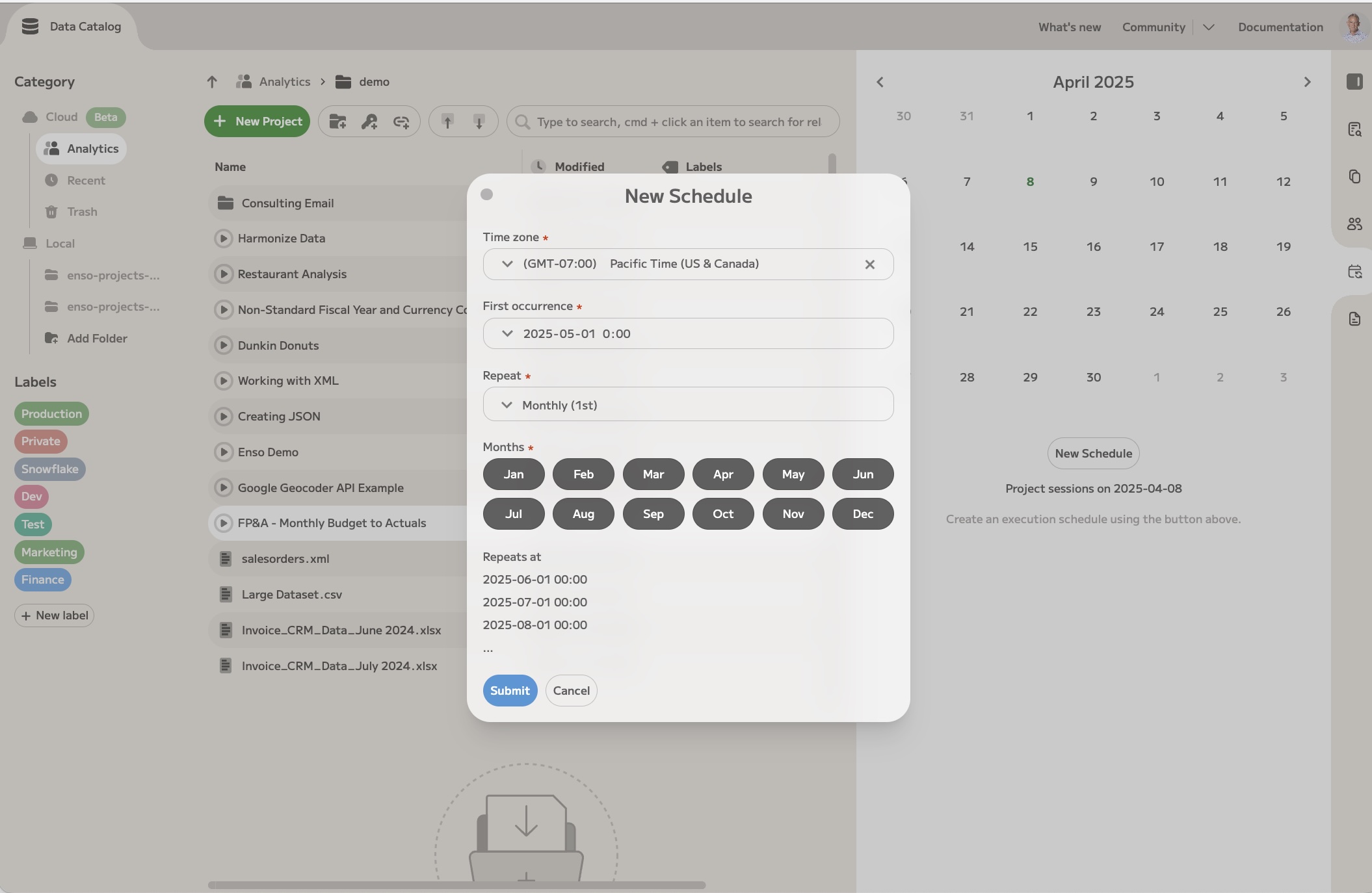

“What sealed the deal was Enso's built-in Cloud Scheduler and team sharing capabilities. Unlike Alteryx, we could set up automated workflows that would run on schedule without additional infrastructure or costs. Plus, the entire finance team could collaborate seamlessly on the same platform.”

— CFO, Mid-sized Financial Services Firm

| Feature | Alteryx | Enso Analytics |

|---|---|---|

| Extensive collection of Data Prep tools | ||

| Self-service implementation | ||

| Workflow Scheduling included | ||

| Team sharing capabilities | ||

| No IT support required | ||

| Never lose your workflow again - Version History | ||

| Native Windows, Mac & Linux Clients | ||

| Desktop & Cloud workflow compatibility |

Self-Service Implementation

Enso's intuitive interface allowed the finance team to build solutions independently, without IT support or external consultants.

“We connected our systems ourselves using the drag-and-drop interface. Within days, we created automated data pipelines that harmonized information across all platforms—no coding required.”

— CFO, Mid-sized Financial Services Firm

Transformative Results

The impact was immediate and far-reaching:

Time Saved

AR aging reduced from one week to a single day, enabling weekly instead of monthly reconcilliations

Strategic Insights

Automated cohort analysis revealed critical customer churn patterns

Remarkable ROI

Automated painful manual processes while gaining complete auditability for each step in the process

The Path Forward

With core financial operations now streamlined, the team is leveraging Enso's self-service capabilities to analyze customer profitability by cohort, channel.

“We've evolved from constantly looking backward to actively shaping our financial future. That transformation wouldn't have been possible without the control and independence Enso Analytics put directly in our hands.”

— CFO, Mid-sized Financial Services Firm